Professor in Residence, Department of Architecture, GSD, Harvard University, Cambridge MA, USA

“Wood City” applies mass timber engineering to the 19 building categories that essentially shape our built environments, otherwise financialized as real estate products by Wall Street. Suburban offices, fast-food restaurants, metal warehouses, big-box grocers, garden apartments, single-family houses, hotels, self-storage facilities, assisted living facilities, strip-shopping centers, etc. constitute 75% of the built environment. Given that the US will double its built environment in just one generation coupled with the urgency to develop low-carbon futures, what if cities were built from the only construction system sequestering carbon and engineered to be “energy positive” – wood? Real estate value chains are undergoing transformations in sectors like fuel retail, fast food, grocery, and logistics, while new interest from venture-capital is hybridizing housing, hospitality, healthcare, and the senior services markets. Innovations in timber-engineered buildings to date have been associated with signature projects involving tall buildings and cultural institutions. Alternatively, Wood City outlines a design research agenda for mass timber through the pattern languages of ordinary building sectors already undergoing novel mixings of space, services, technologies, and experiences.

If we want everything to remain as it is, everything must change.

Elizabeth Kolbert, Under a White Sky: The Nature of the Future (2021)

Mass timber products involving glue-laminated (glulam) technology and cross-laminated timber (CLT) components offer real promise in moving building design approaches from basic product selection to construction systems integration in larger resource economies. Unlike steel and concrete, mass timber is a biotic material in a larger environmental continuum that provides life-affirming ecosystems services. Wood’s renewability makes it a highly sustainable building material in this Age of the Anthropocene – an era in which the greatest challenge to design and planning is the design of cities within human-dominated ecosystems. Wood’s supply chain from forest to frame, poses the possibility of improving regenerative services at every step of wood’s life cycle within a milieu of energy excess.1 There is a lot of wood; forests need extensive thinning to prevent catastrophic fire; and we can continually plant trees.

This paradigm of energy excess affords us the ability to invest in associated management processes otherwise unattainable in current construction economies – improved stewardship of forest ecosystems, development of low impact factory-based fabrication processes, construction of buildings to be carbon sinks, and design of building components for disassembly and reuse to forestall material waste. Conversely, the prevailing conception of energy in architecture is organized around conservation and austerity, one that architect and building energy expert Kiel Moe tells us is a “thermodynamically pessimistic paradigm and ultimately a futile pursuit” as it “conditions architects to work on the wrong problem.” 2 The big question is: which forcing functions will tip building markets to adopt such life-cycle thinking in their business models toward circular construction economies? “Wood City” proposes a pathway based on the application of mass timber engineering to the 19 building categories that essentially shape our built environments, those financialized as real estate products by Wall Street.

The stakes are high, as the equivalent of 92% of America’s nonresidential space that existed in 2010 will be built or rebuilt by 2030.3 The US will have practically doubled its built environment in just one generation. Given climate change projections and the urgency for developing low-carbon futures, what if cities were built from the only building construction system that sequesters carbon; is a renewable resource; and is capable of being “energy positive” – wood? Unlike metals and plastics, wood is a biological nutrient capable of regeneration.

WOOD CITY IS REGENERATIVE

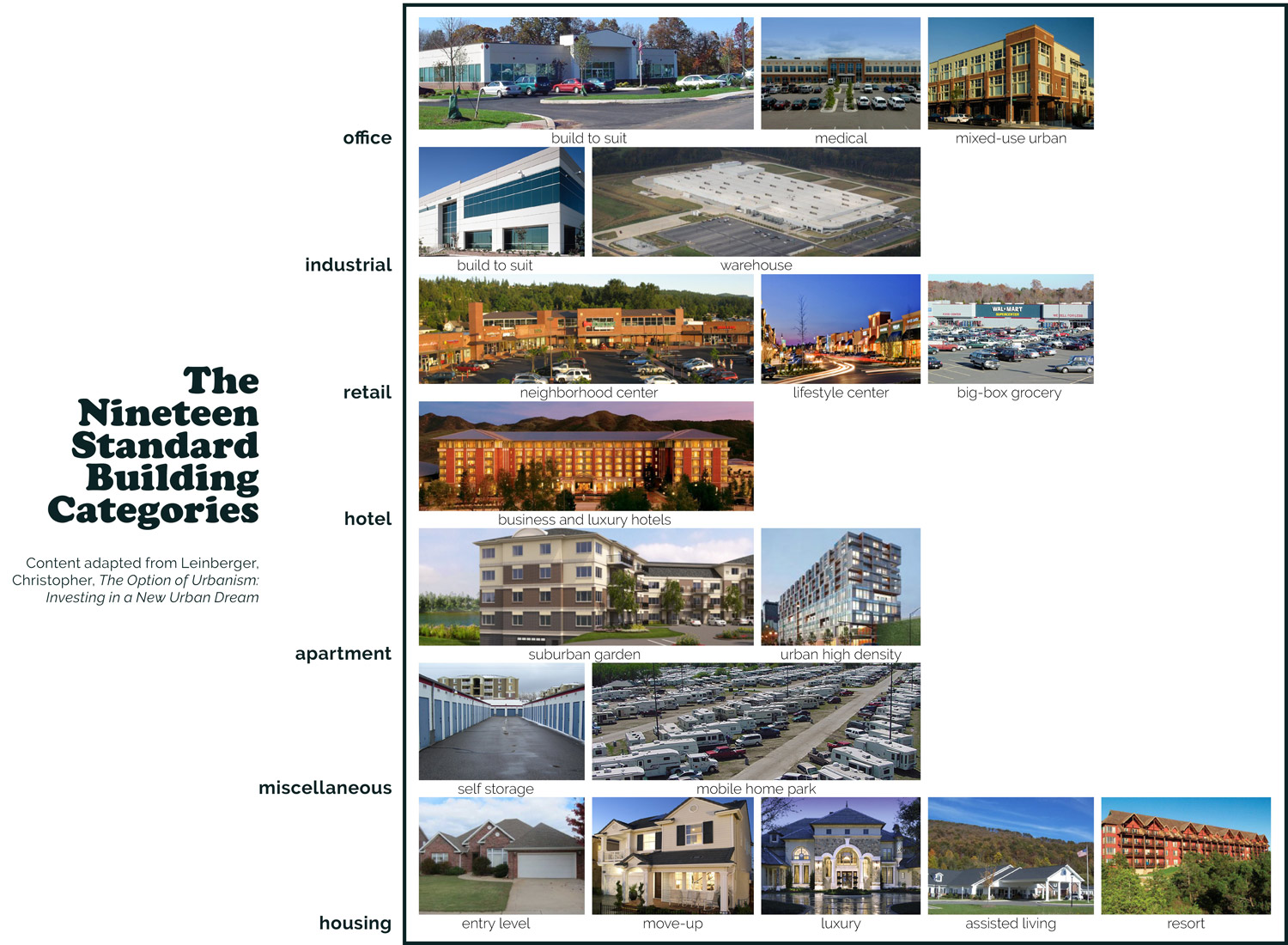

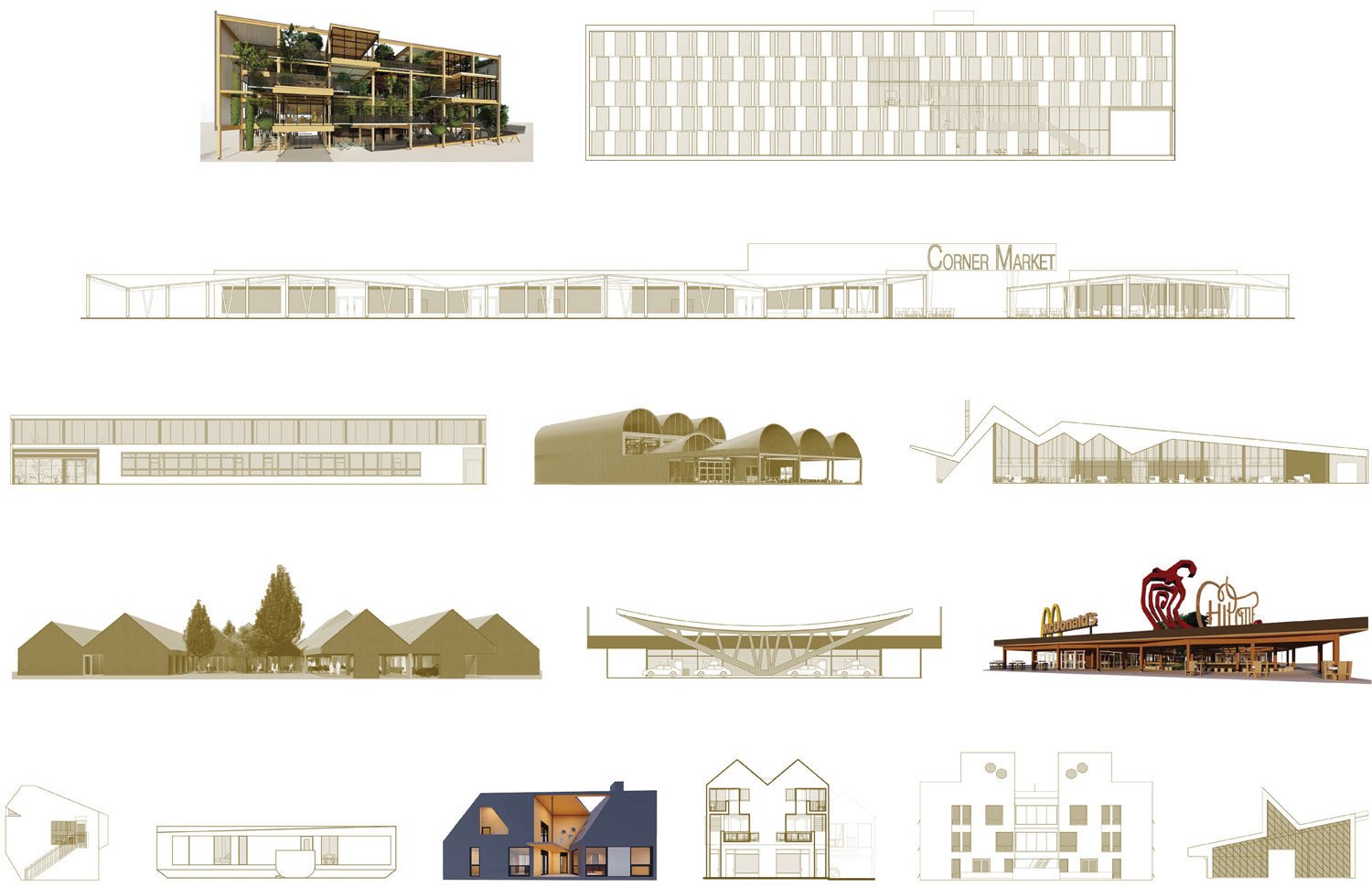

According to planning expert Christopher Leinberger in The Option of Urbanism: Investing in a New Urban Dream, nineteen standard real estate products (Wall Street does not even call them buildings) constitute most of the built environment. This private construction market comprises 78% of annual capital expenditures on buildings,4 of which the nineteen commodity building sectors are the majority subset. These nineteen building categories are the de facto building blocks of our metropolitan areas – including suburban offices, fast food restaurants, metal warehouses, big box grocers, garden apartments, single-family houses, hotels, self-storage facilities, assisted living facilities, neighborhood shopping centers, etc. (Fig. 1).

They are more financial and logistical expressions of space than architectural achievements. As capital assets in massive supply chains and development industries these building categories represent over one trillion dollars of annual capital expenditures.5 Yet they are premised on short-term investment cycles made possible by cheap construction systems with high embodied energy costs and other negative externalities related to pollution, waste, and ecosystem depletion.

Nonetheless, their standardized building organizations already support franchised operations ideal for rationalization under mass timber prefabrication processes. Fortuitously, the real estate value chain

is undergoing its own next-generation shifts, including that from a singular commitment to economic bottom lines toward more holistic triple-bottom-line accounting for social and ecological goods. The Environmental, Social, and Corporate Governance (ESG) movement, for instance, has shifted corporate conscience and investor allocations to reward sustainable and resilient practices, signaling a broadening opportunity for integrating mass timber into the logistical space of real estate development sectors.

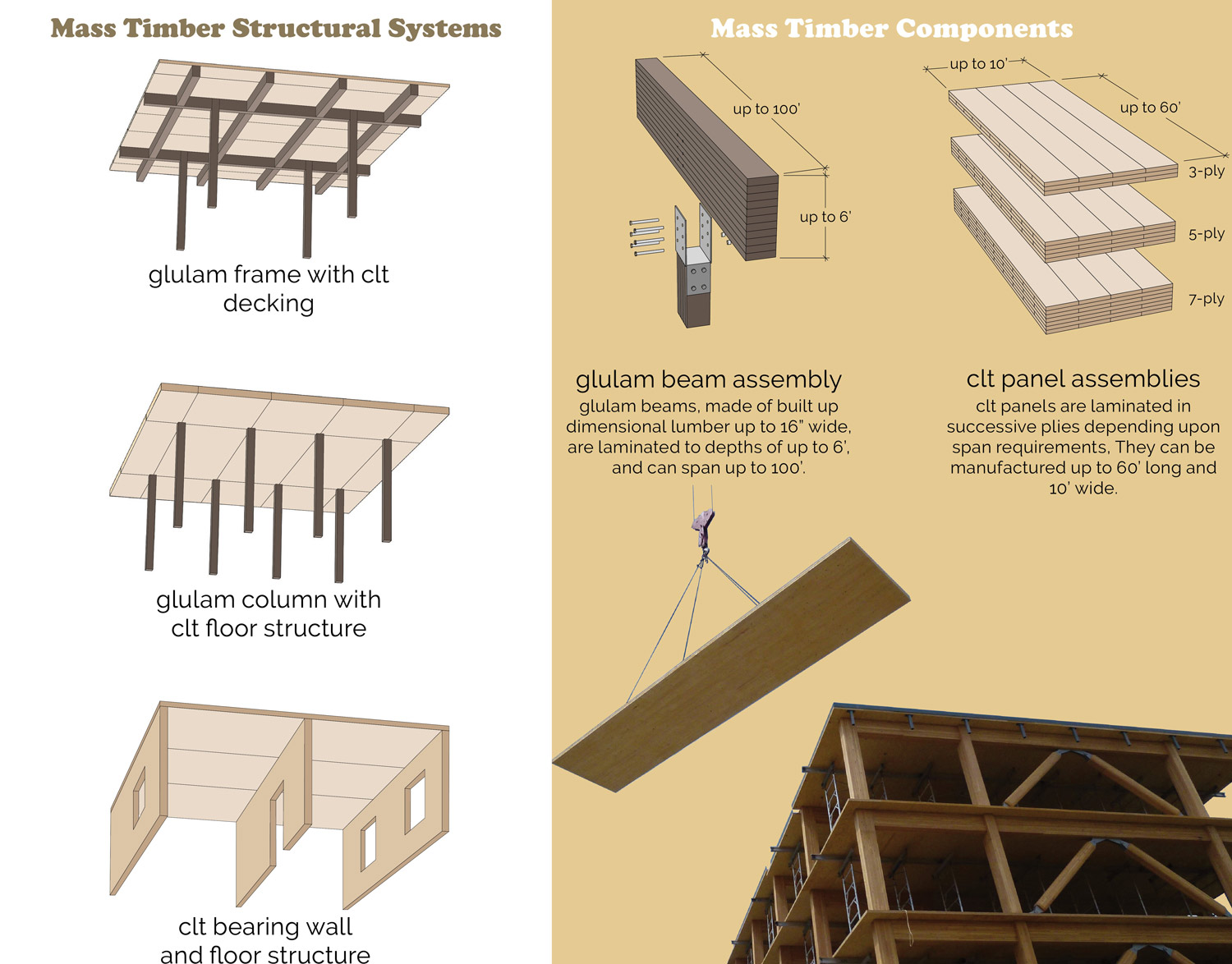

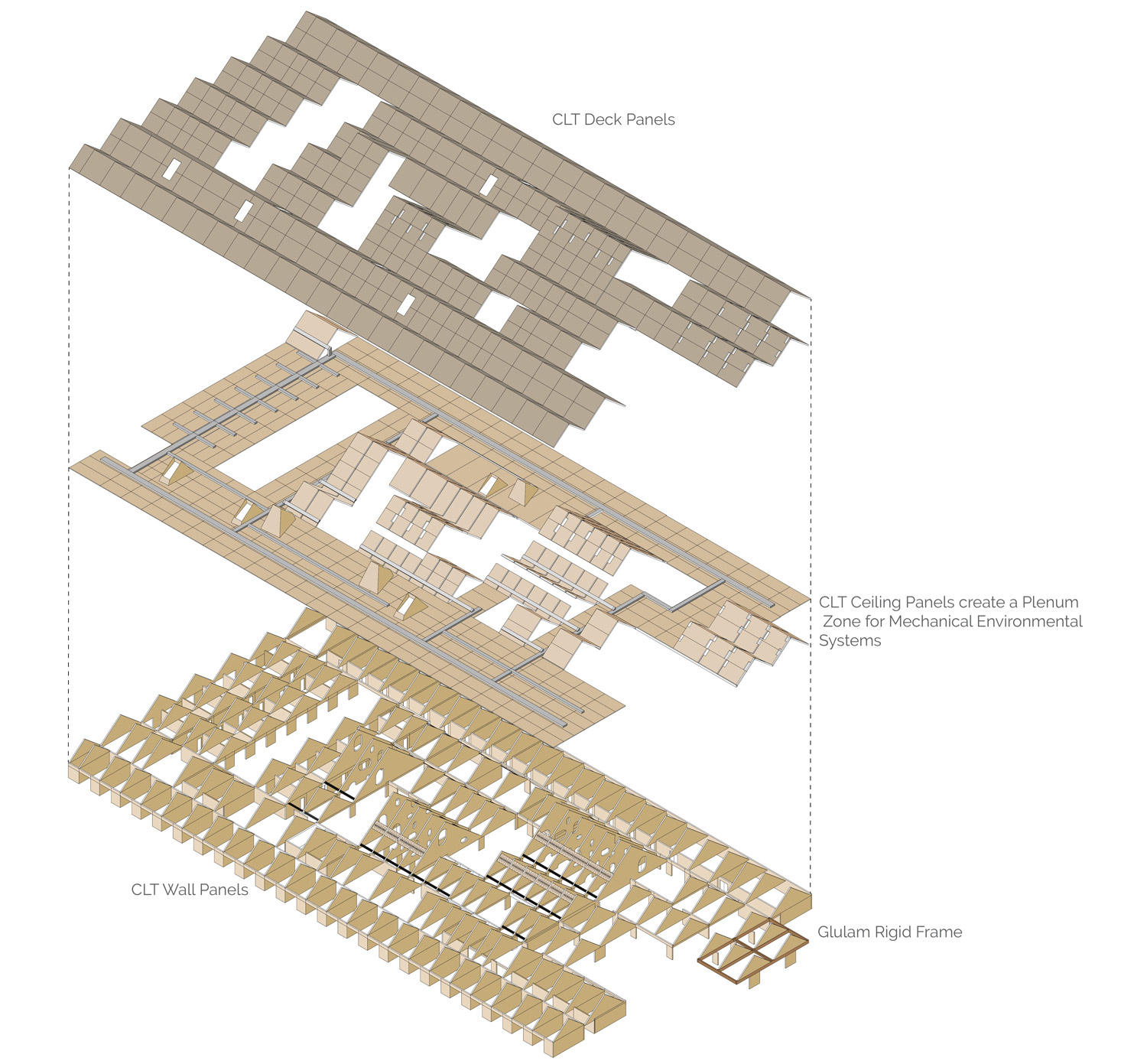

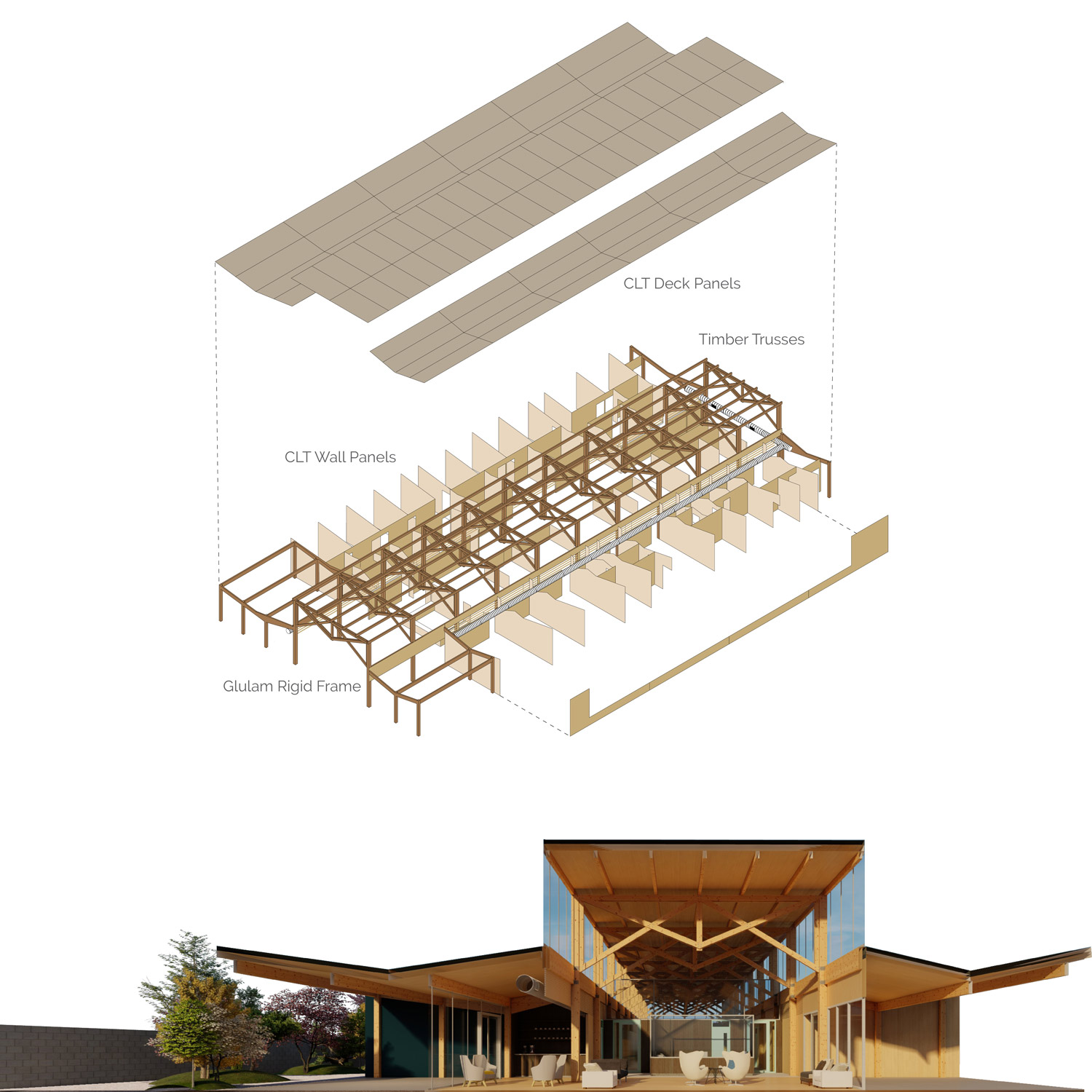

Accordingly, Wood City rethinks common building typologies through factory-based timber-engineered building platforms as an alternative to concrete, steel, and light-frame dimensional lumber construction (Fig. 2).

CLT is a twenty-five-year-old technology developed in Europe and gradually gaining acceptance in North America, but for now only among elite clientele. Timber is easily machinable given its light weight and ease in splicing, lamination, and assembly that support CNC-based prefabrication processes.6 Factory-based mass timber construction premised on the lamination of wood members in the form of wall and roof panels, structural beams and columns, or whole building units has become cost competitive with concrete and steel systems. Unlike dimensional wood used for light-weight framing, laminate manufacturing leverages timber sourced from low-grade trees to high-performance high-quality structural and cladding building components (Fig. 3).

Laminate fixing technologies include nailed, doweled, and friction connections beyond glue in a wide range of cladding and structural solutions. Lamination affords wood greater structural and fire-proofing properties (not achievable with the family of engineered wood products consisting of dimensional lumber, plywood, and oriented strand board products) comparable to concrete and steel without either’s heavier and thus costlier weight or negative environmental externalities. Ongoing research into mass timber’s behavior in structural stress, fire, and seismic testing suggests that building codes will not be a primary obstacle to its widespread adoption. Rather, the challenges will be in the economies of scale governing small and medium size buildings where mass timber does not yet pay out when using traditional economic accounting. Economics does not yet account for the liabilities in waste and pollution from planned obsolescence (the opposite of regenerative) in building material systems.

Despite lamination’s limits in flexibility and form (planks are inherently flat, structural, and unbendable), CLT kit-of-parts and whole-building systems are well suited to the economy of means demanded in commercial building design. Whether for a retrofit or new construction, mass timber prefabrication practically eliminates material waste, and “buildings are 25% faster to construct than concrete buildings and require 90% less construction traffic.” ⁷ Moreover, prefabrication and technological innovation generally are providing solutions to the nation’s permanent shortage of skilled construction labor due to an aging workforce and fewer younger workers pursuing careers in the construction trades. According to an industry trade group, 80% of construction firms will be unable to fill hourly and salaried positions, while 72% of firms identify labor shortages as their top hurdle ongoing.⁸ While most contemporary building components embody some form of standardization, prefabrication shifts entire building processes away from the site to the factory and is the industry’s future for many reasons. Mass timber offers the best value proposition as a primary material base in establishing sustainable prefabrication construction economies.

THE EVOLUTION OF INFORMATION-RICH REAL ESTATE VALUE CHAINS

Innovations in timber-engineered buildings to date in the US have been associated with signature projects involving tall buildings and institutional structures like the T3 office building in Minneapolis by Michael Green Architecture and the DLR Group, the Adohi Hall dormitory at the University of Arkansas by Leers Weinzapfel Associates and Modus Studio, and the Common Ground High School in New Haven, Connecticut by Gray Organschi Architects. However, the ordinary low-rise building types comprising America’s auto-oriented landscapes hold the key to revolutionizing the nation’s carbon footprint through better building, urbanism, and land use at scale. Wood City introduces mass timber technology into the development value chain where many of these ordinary building sectors are already undergoing novel mixings of space, services, technologies, and experiences. The real estate development value chain is being recast in sectors like fuel retail, fast food, grocery, and warehousing, while new interest from venture-capital is hybridizing sectors in housing, hospitality, healthcare, and the senior services markets in value-adding ways. Anticipating new flexible building platforms like co-living, logistics facilities with public or “third place” spaces, free-standing restaurants that become food halls, strip shopping centers as community hubs, and the office-as-garden, Wood City proposes a new architecture of the ordinary rooted in a regenerative material system.

Real estate represents 35% of the US economy with housing constituting 56% of the built environment, non-residential 28% of the built environment, and infrastructure 16% of the built environment.⁹ The Urban Land Institute’s (ULI) annual status report on real estate, Emerging Trends in Real Estate 2020, chronicles ongoing sector disruptions in logistics/storage, manufactured housing, shopping centers, multifamily housing, and senior assisted living. Notably, rising investor interest in the ESG movement, renewable energy, and fleet electrification are changing building landscapes and promising to reset future risk assessment, capital deployment, and community relationships. ESG will be a primary forcing function compelling shifts to circular resource economies in construction.10

Aside from realignments in technology and development, one of the more impactful disruptors in real estate are the capital markets themselves. An abundance of idle debt and equity capital – by many estimates well over one trillion dollars – is seeking long-term returns in venture-driven investment associated with new kinds of real estate products.11 Notwithstanding the obstinance of an inefficient building industry to change, innovation is now crucial in “bending the cost curve” to counter real estate development cost escalations that continually outpace inflation. A growing number of investors including retirement funds are privileging “patient capital” models over short-term liquidity needs; a shift in benchmarking which bodes well for the intersection of wood-based prefabrication with other trends. These market resets are powerful and constitute what the ULI calls the “the real estate of the future.” 12

Mobile Home, Garden Apartment, and Accessory Dwelling Unit

ULI real estate future portends both positive and negative trends, the latter including the nation’s structural housing crisis as we continue to build “90% of our housing for 10% of our households.” 13

Labor shortages, unpredictable material supply chains, and outsized increases in construction costs diminish margins for anything but premium housing. This unprecedented supply inequity is creating a sharp rise in demand for mobile (manufactured) homes, a prefabrication-based industry ripe for mass timber applications as large-scale capital is moving into the development of manufactured home communities for all income groups.14 Manufactured homes are now being incorporated into high-income gated communities attracting venture capital investment including Real Estate Investment Trusts (REITs) and national developers aiming to avoid local materials and labor costs. The industry has evolved greater customization and flexibility in the design and construction processes, responding to amenity demand from all income groups. Accessories include porches, garages, foundation systems, and roof options.

Falling homeownership rates to levels not seen in sixty years has created a pressing need for multifamily housing particularly in costly strong-market regions plagued by construction labor shortages. Accounting for more than one-half of all apartment construction, the garden-sector is delivering more amenity space per unit than older models, including incorporation of outdoor courtyards and roof gardens 15 (Fig. 4).

Unlike mid-rise buildings, garden apartments are compatible with suburban codes and faster to build. Such a convergence of challenges has already nudged some housing production to prefabrication.

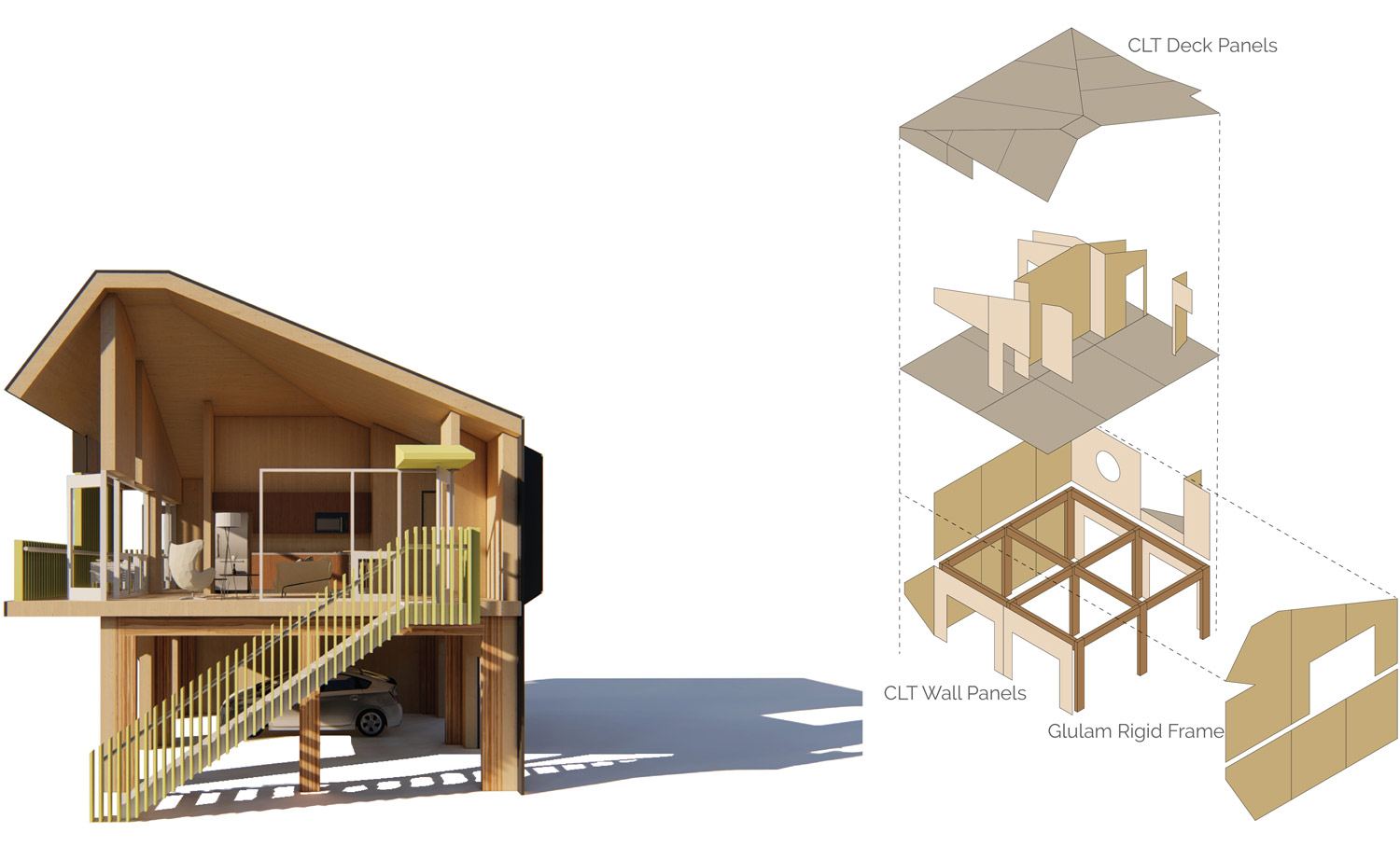

Meanwhile, cities are relaxing municipal codes to permit again the development of accessory dwelling units (ADUs) on parcels zoned for single-family residences.16 Ranging from 150 to 800 sq. ft. [14 to 74 m2] these self-contained residential units can be attached to the primary residence, sit atop a garage, or stand alone as a cottage in the backyard (Fig. 5).

ADUs fill market gaps for affordable, senior, entry level, and intergenerational households. Also known as mother-in-law suites, ADUs add density to neighborhoods, especially in areas lacking multifamily housing. Because of its small scale and high costs per sq. ft. for on-site construction, the ADU is an ideal sector for prefabrication. Indeed, companies, including Amazon, are entering the market, providing turnkey prefabrication and/or property management solutions for homeowners. As infill units easily customized to accommodate special needs, ADUs offer an additional option for aging in place.

Tenant Office and Hotel

A positive real estate trend involves the incorporation of community values into building sector development from offices to retail and housing, exemplified in the burgeoning popularity of co-living and co-working developments. Impacts of the sharing and gig economies are becoming apparent in property development, particularly in the tenant office sector where networking and socializing have become essential aspects of work 17 (Fig. 6).

Capitalizing on the co-working model, hotels are selling memberships to fulfill demand for high-amenity work environments that promote wellness, even discounting room rates. Like the office sector, consumers are favoring hospitality environments with ESG business models and branding that communicate these values shifts. Ample research shows that wellness and biophilic design in work environments through incorporation of natural materials like wood (given its visual and thermal effusivity or warmth), landscapes, and natural light, directly affect enterprise productivity according to a keynote industry report “Human Space: The Global Impact of Biophilic Design in the Workplace” (2015) – the move to quality will lead to greater selectivity among office sector tenants post-COVID-19 as one-third of office workers before the pandemic indicated that office design would impact their decision to join a company.19

Logistics: Warehouse and Self Storage

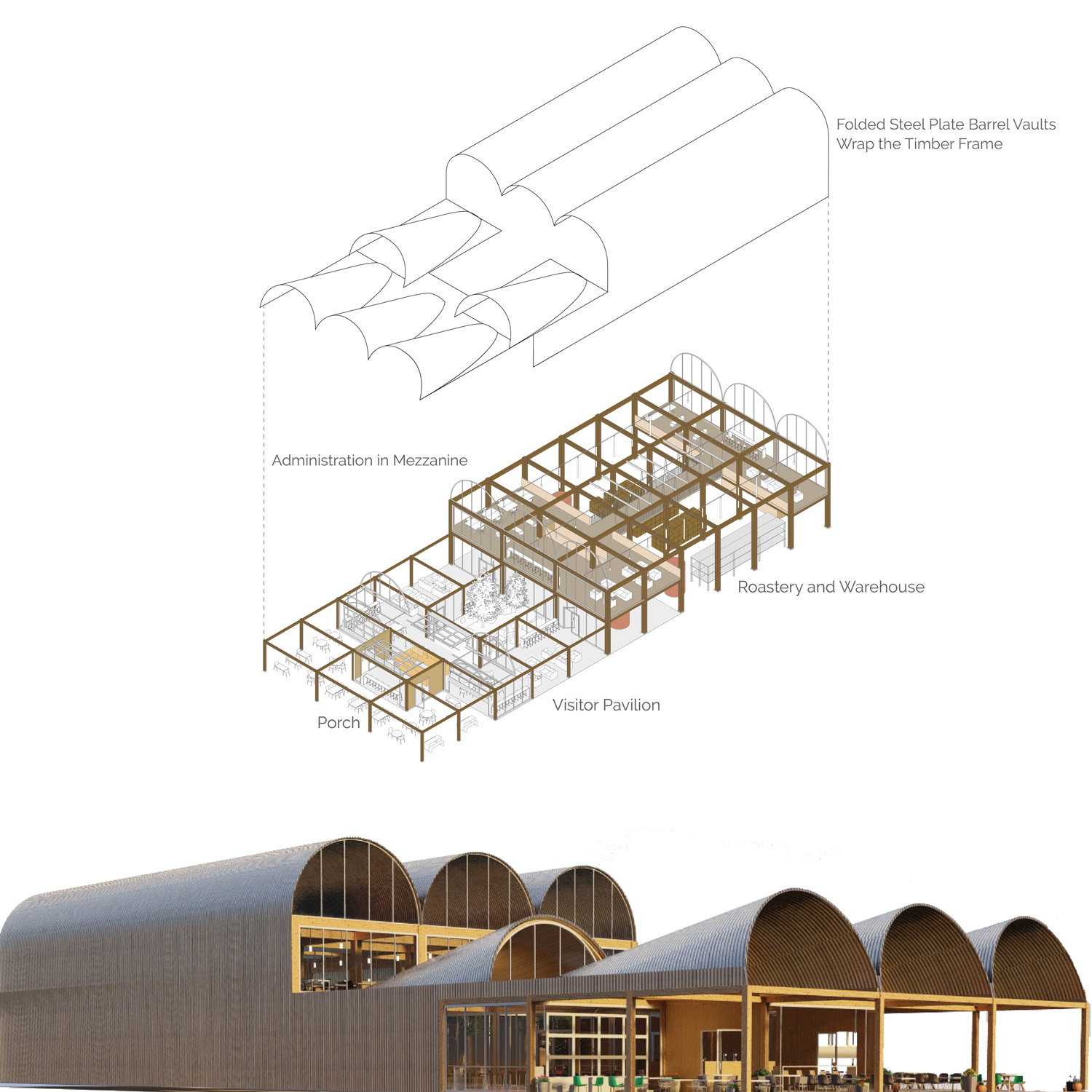

Separate operations serving mixed retail and warehouse functions are converging in response to the new demands of frictionless omnichannel retail: multi-dimensional shopping experiences synergizing online, in-store, and various fulfillment modalities. Parcel fulfillment facilities in last-mile logistic chains and self-storage complexes are incorporating mixed uses as their operators locate facilities closer to population centers. Yet, logistics-oriented building categories are ill-equipped to comply with ever more stringent design regulations governing incorporated areas since their development patterns never rise above the bottom line.20 Packaged metal buildings housing light-manufacturing functions mixed with retail uses like coffee roasteries, micro-breweries, food production, and durable goods retail (let’s throw in fitness centers and megachurches – the newest “third places” and large users of prefabricated metal buildings) are no longer able to get away with standard metal warehouse shells lacking good public frontage and environmental ambiance (Fig. 8).

As well, demand for climate-controlled self-storage units is growing as high-value goods including vehicles, art, and commercial stock for businesses require conditioned storage (Fig. 9).

Buildings in this sector continue to evolve toward high performance investment-grade mixed-use buildings from their beginnings as simple garages, now attracting institutional investors. In the high-growth logistics sector, mass timber construction would better serve building markets already parameterized around prefabricated building but now tasked with delivering higher levels of aesthetic and environmental quality than current packaged warehouse systems.

Big-Box Grocery, Strip Shopping Center, and Fast Food Restaurant

Even once “category killer” big-box grocers that eschewed stores for warehouses, are integrating fulfillment strategies, experience economies, and educational outreach into the warehouse, creating destination experiences (Fig. 10).

Grocers, including the growing community of food co-ops now numbering over 200 with 1.3 million members in the US, are becoming merchant oriented again as they deliver new forms of “collaborative consumption” that integrate “platforms of products, services, and experiences.” 21 Thus, real estate based in placemaking and expressions of wellness and authenticity, particularly appealing to millennials and generation Z as underscored in the ULI report, are important secular trends. Even online retailer Amazon is improving its omnichannel retailing having recently built 591 retail stores, more than most national chains. Through the purchase of big-box retailer, Whole Foods, Amazon recognized that selling food accelerates omnichannel retail business models.22 These business models are premised on delivering high-quality experiences through standardized building types with memorable design – collectively, a great case for mass timber construction.

Unlike other sectors, retail and office sectors require continuous capital expenditures just to maintain market competitiveness. Neighborhood strip centers, once underutilized value shopping formats, are hybridizing to become one of the hottest retail sectors combining goods and services.23 Many centers already have fitness gyms and grocery stores as anchor tenants, generating multiple weekly customer visits. Presently, strip center operators are aggressively customizing their properties by incorporating allied community facilities, family areas, omnichannel consumer services, and entertainment venues as destination experiences. They are capitalizing on their locations in first ring suburbs among dwelling units and urban cores while experimenting with “town square” concepts to build sustained consumer streams. Eighty-two percent of millennials still prefer to shop in stores after researching products online. Like with the tenant office sector, Wood City proposes a retrofit strategy of building frontages with arcades, display windows, and open-air pavilions for application to existing buildings (Fig. 11).

One-sixth of the American population eats at a fast food restaurant every day. Known as Quick Service Restaurants (QSR), fast casual and fast food restaurants account for 50% of total sales in the restaurant sector.24 QSRs are constantly morphing their menus in response to changing consumer demand for healthier more diversified food options with local fresh food sourcing. The more competitive franchises are improving the social experience while limiting costly expenditures on indoor dining environments. Too, the QSR landscape is expanding services related to catering, event making, and delivery, while co-locating within larger stores or food halls and malls challenging the dominance of standalone fast food franchises. Just as regionalization changes menus, hybridizations of fast food and fast casual coupled with new experience economies in ever more densifying and vitalizing suburban environments will change the sector’s building and urban formats (Fig. 12).

REAL ESTATE AS A SERVICE (REaaS)

Assisted Senior Living and Medical Office

Due to novel forms of demand, scale, and returns on investment converging around select property classes, some building categories will be further rationalized as services, mostly through interventions by large-scale venture capital. Buildings are undergoing the same shifts in property tenancy as those for cars and homes: from traditional ownership models to subscription-based consumption of services on demand (vacation time share was an early form of this). Care services for aging populations is one such sector. Between 2010 and 2030, 10,000 people will turn sixty-five every day, leading to a quadrupling of octogenarians by 2030. Longevity is increasing, aided by advancements in the life sciences, which places considerable pressure on an already stressed housing market. The current national housing stock does not adequately accommodate aging, let alone the looming scale of need by a senior population projected to double from forty million in 2010 to seventy-nine million in 2030 – one-fifth of the nation’s projected population.25

Special-interest housing will likely be supplied through diverse congregate-living channels – multifamily, manufactured housing communities, co-housing, independent living-based pocket neighborhoods, assisted living, and costly medical-based institutional housing – all favorable to prefabrication construction economies given the complexities in integrating healthcare services, artificial intelligence, and real estate products into a singular “smart” platform (Figs. 13, 14).

In its discussion of senior needs as they pertain to real estate the ULI report observes, “senior housing is increasingly recognized as a critical part of the solution for population health management and health care cost containment – a growing social, economic, and political reality. Indeed, facility operators including those for outpatient and multi-specialized medical offices are creating their own managed Medicare organizations” 26 as capital vertically integrates building markets for the aging that look more like hospitality environments (Fig. 15).

Co-living and co-working building categories follow a similarly customer-centric mindset as markets for the aging through on-demand subscription services offering combinations of beds, workspace, community, and amenities that are scalable and flexible. Particularly in the living sector, consumers want access to different forms of housing bundled with various kinds of services as their lifestyles evolve. In delivering turnkey solutions of greater complexity, all living space may eventually become leasable, relieved from the inefficiencies in retail exchange. As the nineteen building categories undergo novel mixings of space, services, technologies, and experiences toward integrated but flexible platforms, new research and development opportunities arise for architects. Wood City outlines new intersections among building category logistics, social practices, and design thinking to find opportunity in their economy of means – building categories that, despite their “modernity,” have abandoned architectural and urban design. ambition. The challenge is to diffuse the findings of capital-intensive innovation in mass timber technology at the top of the architectural food chain to common building types within their respective cost structures. How might design innovation fulfill functional and economic obligations for which an ordinary building is financed and built, while offering collateral benefits – expressions of publicness, renewed senses of beauty, and enhanced responsiveness to livability and context typically missing in these building products? (Fig. 16.)

CONCLUSION: DESIGN AS WORK ON THE WORLD

Wood City then takes up Keller Easterling’s challenge in Medium Design: Knowing How to Work on the World, to move beyond the project to engage matrices and ecosystems and their interdependent indices through “protocols of interplay, not things, but rather parameters for how things interact with each other.” 27 Work on wicked problems entails more the articulation of an ecosystem vocabulary as well as “medium thinking” beyond solutionist thinking. Materiality has a central role in shaping the urban once we stop parsing information in the topographic arts and work with the interconnectivity of co-existent technologies in fabrication, building types, logistics protocols, and geographic/territorial formations, rather than treat them only as successive specializations.

Even markets that once viewed buildings as simply products, are beginning to see the potential of buildings as services platforms, which will likely include monetizing the environmental consequences of the very building components themselves. Less “smart building” in its overemphasis on sensors and data in constructing feedback, and more a metabolic consciousness concerned with circular macro-economies that intwine cultivation, extraction, fabrication, use, disassembly, and reuse in solving for multiple challenges and opportunities simultaneously. Indeed, design culture’s underlying social imperative now demands vocabularies structured around “coupled human and natural systems” known as CHANS. We can grow regenerative forests and cities alike: a point roundly made by architects pioneering connections among mass timber construction, urbanism, and forestry.28 Just imagine a future where basic biophilic qualities are encoded into our commercial landscapes.

Regenerative design requires regenerative economics. But can design nudge policy toward the development of circular resource economies? Policy could incent markets to connect sustainable forestry management practices in sourcing wood as a reliable feedstock with building markets and prefabrication operations scaled and staged for timber. Tree thinning is desperately needed in America’s undermanaged and overgrown forests—the fourth largest forest area in the world at over 310 million ha.29 Tree thinning for instance, strengthens nutrient cycling and optimizes other ecosystem services within forests, including fuel reduction to reduce the risk of catastrophic fire or “disturbance regulation”. Restorative thinning costs can be countered through revenue gained from the sale of low-grade trees as new feedstocks for mass timber buildings, since forest managers across the US need to find markets for one billion cubic feet of wood per year.30 There is abundant supply just from thinning, though its operational scale and labor intensiveness would mostly serve regional supply chains. The wood from forest thinning alone is more than enough to supply the nation’s annual count of single-family housing starts. Foresters understand that markets for wood create healthier forests.

Wood is a carbon pool, capable of transferring the forest’s stored carbon into buildings. But not all forests and trees are the same. The amount of carbon stored in forests and trees – an important distinction – is constantly changing. Policy based on carbon accounting will require greater research triangulating the ecosystem status of forests, tree species condition, and their actual carbon sequestration capacities. Life cycle assessments (LCAs) begin at extraction and thus do not account for actual carbon flows since embodied carbon varies with the condition of the forest based on its type (i.e., tropical, temperate, boreal), soil health, decomposition rates of biomaterials, and disturbance regimes (e.g., insects, disease, fire, etc.). For example, tropical forests store two-thirds more carbon in their biomass than other forest types where 69% of their sunk carbon is stored in the soil.31

Old forests accumulate more carbon than young forests, but the latter’s higher growth rates remove more carbon from the atmosphere. While the amount of carbon stored in a tree (approximately half of tree’s dry weight) depends on its size, age, and species, older trees generally store more carbon through their mature leaf canopies. Though older trees are less efficient processors of carbon than younger trees, “if a tree’s diameter grows ten times as large, it will undergo a hundredfold increase in leaf mass and a fiftyfold to one hundredfold increase in total leaf area. This outweighs the lower rate of productivity” according to a comprehensive study of carbon flux in forests.32 Sourcing practices legitimizing new urban material economies of mass timber, then, will have to depend on more information-laden representations of carbon flows across the several scales of biological organization governing the pulsing cycles of forests.

However, LCAs that account for the bio-geophysical space of forests is complicated by the various ways in which wood is harvested, traded, processed, and consumed in worldwide commodity supply chains, which are now essentially corporate black boxes. No matter how remote a forest, wood is a global resource subject to the political economy of timber and its shifts from intraregional to international trade. Low costs drive exchange in established commodity markets often leading to upside down outcomes. For instance, the US is the world’s seventh largest exporter of softwood lumber yet imports over 30% of its annual softwood lumber consumption.33 In their excellent chronicle of timber markets, Timber, Peter Dauvergne and Jane Lister explain the secular market shift from sourcing once dominated by forests and wood companies of the North – vertically integrated around the mill – to a few vertically integrated multinational discount retailers that primarily source wood from industrialized rapid-growth tropical tree plantations of the South.34 The next economic reset of the timber market is certain yet unpredictable since catalysts for “new work” in its fresh objectives and relationships do not flow from the old work – a persistent theme in Jane Jacobs’ writings on economic behavior. But given three new imperatives in creating lower carbon futures, linking improved forest stewardship to management of wood supply chains, and elevating sustainability performance in building sectors, could real estate development value chains connect the dots to integrate the city into the carbon cycle, embedding wood in the socio-ecological metabolism envisioned by Wood City?

Former WeWork executive, Michael Caton, suggests that engineering and architecture teams can break through old professional delivery models by focusing less on project-based alliances and instead “focus more on claiming ownership of even broader segments of the value chain, stretching downstream toward manufacturing and construction, upstream toward property development and asset management, or both.” 35 According to Caton, architects can gain new expertise since real estate development based approaches “offer architects an invaluable resource long sought in project-based practices: performance feedback on built environments that can be leveraged to improve future outcomes.” 36 Caton predicts that standalone architectural and engineering services firms will be further integrated, if not subsumed, as R&D components into larger value chain organizations controlling prefabrication, real estate development, building design, and other specialized services managing material custody loops.

Like most of the world, 85% of Americans live in low-density metropolitan environments outside of the nation’s top fifty urban cores,37 suggesting that the centrality of future prosperity is tied to urbanization processes in suburban peripheries. Wood City begins with the dilemmas of a perceived “throwaway” culture among ordinary building sectors towards turning low-density metropolitan fabrics into carbon sinks with improved land use. Since the demolition of wood buildings releases carbon back into the atmosphere, longevity in wood buildings is a socio-environmental asset. One day, this public good will likely be monetized. Using mass timber technology, Wood City develops sustainable pattern languages with architectural ambition for these building blocks of America’s low-density metropolitan sprawl. While patterns are aligned with new development trends redefining each building category, each pattern can link up using grammar-like rules to create new placemaking possibilities. Wood City essentially outlines an important yet untapped design market within multiple building sectors requiring greater applied research and the value-adding intelligence of design. Good design is capital.

In contrasting energy paradigms based on either excess or conservation, Kiel Moe also presents a very useful discussion on the social construction of technology and architecture’s tendency to teach its technical practices as autonomously determined. Taking from Lewis Mumford, and Gilles Deleuze two generations later: technology is always social before it is technical. See Kiel Moe, “Compelling Yet Unreliable Theories of Sustainability,” Journal of Architectural Education 60, no. 4 (May 2007): 24-25 - doi:10.1111/j.1531-314X.2007.00105.x.

Ibid.: 24-25.

Arthur Nelson, Reshaping Metropolitan America: Development Trends and Opportunities to 2030 (Washington DC: Island Press, 2013), 80.

U.S. Census Bureau, “Monthly Construction Spending, December 2020,” CB21-19, February 1, 2021 - https://www.census.gov/construction/c30/pdf/release.pdf.

Ibid.

ARUP, Rethinking Timber Buildings: Seven Perspectives on the Use of Timber in Building Design and Construction (London: ARUP, March 2019), 42 - https://www.arup.com/perspectives/publications/research/section/rethinki....

David Roberts, “The Hottest New Thing in Sustainable Building Is, Uh, Wood,” Vox (January 15, 2020) - https://www.vox.com/energy-and-environment/2020/1/15/21058051/climate-ch....

Associated General Contractors of America, “2020 Construction Outlook Survey Results” -

https://www.agc.org/sites/default/files/Files/Communications/2020_Outloo..., accessed March 4, 2021.

Christopher Leinberger, The Option of Urbanism: Investing in a New Urban Dream (Washington DC: Island Press, 2007), 33, 47.

PwC and the Urban Land Institute, Emerging Trends in Real Estate 2020 (Washington DC: PwC and the Urban Land Institute, 2019), 17-18.

Ibid., 4.

Ibid., 8.

Ibid., 11.

Alex Pacurar, “Mobile Home Park Investment Trends in 2019,” Multi-Housing News (September 11, 2019) - https://www.multihousingnews.com/mobile-home-park-investment-trends-in-2....

For market trends in apartment construction, see Bendix Anderson, “Garden-Style Apartment Projects Allow Developers to Expand in the Suburbs,” National Real Estate Investor (July 30, 2019) - https://www.wealthmanagement.com/multifamily/garden-style-apartment-proj...; and Liz Froment, “Developers Eye Growth of Garden-Style Apartments in the Suburbs,” LoopNet (September 11, 2019) - https://www.loopnet.com/learn/developers-eye-growth-of-garden-style-apar....

For trends in the accessory dwelling unit market, see “Accessory Dwelling Units (ADUs) In North America,” Centre for Public Impact (April 1, 2016) - https://www.centreforpublicimpact.org/case-study/accessory-dwelling-unit...; and Aaron Norris, “2020: The Year of the ADU,” Forbes (December 30, 2019) - https://www.forbes.com/sites/aaronnorris/2020/12/30/2020-the-year-of-the....

PwC and the Urban Land Institute, Emerging Trends, 13.

“The Next Five Years: Future Hospitality Industry Trends You Need to Know”, Social Tables - https://www.socialtables.com/blog/hospitality/hospitality-industry-trends/, accessed December 6, 2021.

Sir Cary Cooper and Bill Browning, Human Space: The Global Impact of Biophilic Design in the Workplace, Interface (2015) - https://greenplantsforgreenbuildings.org/wp-content/uploads/2015/08/Huma....

For market trends in logistics-oriented building types, see Steve Hajewski, “6 Trends Affecting Self-Storage Development in 2020,” Inside Self-Storage (February 8, 2020) - https://www.insideselfstorage.com/development/6-trends-affecting-self-st... and Scott Meyers, “A Look at Self-Storage Growth Trends Now and Post-Pandemic,” Forbes (December 1, 2020) - https://www.forbes.com/sites/forbesrealestatecouncil/2020/12/01/a-look-a....

PwC and the Urban Land Institute, Emerging Trends, 14.

For market trends in big-box retailing, see Tricia McKinnon, “6 Reasons Why Big Box Retailers Pose a Threat You Should Worry About,” Indigo Digital (October 30, 2020) -

https://www.indigo9digital.com/blog/fbigboxretailerssuccess; and Melissa Repko and Lauren Thomas, “6 Ways the Coronavirus Pandemic Has Forever Altered the Retail Landscape,” cnbc.com (September 29, 2020) - https://www.cnbc.com/2020/09/29/how-coronavirus-pandemic-forever-altered....

For market trends in strip shopping center development, see John Fioramonti, “The Changing Face of America’s Retail Shopping Centers,” Kidder Matthews Research (August 27, 2020) - https://kidder.com/trend-articles/the-changing-face-of-americas-retail-s... and Anna Hensel, “Why Strip Malls Are Becoming More Popular among Retailers,” Modern Retail (February 10, 2020) - https://www.modernretail.co/retailers/why-strip-malls-are-becoming-more-....

For market trends in fast food see, Alex Fainblum, “Fast Casual vs Fast Food,” TouchBistro - https://www.touchbistro.com/blog/fast-casual-vs-fast-food/, accessed February 22, 2021; and Matt Sena, “Fast Food Industry Analysis 2020 – Cost & Trends,” Franchise Help - https://www.franchisehelp.com/industry-reports/fast-food-industry-analys..., accessed February 22, 2021.

D’Vera Cohn and Paul Taylor, “Baby Boomers Approach 65 – Glumly,” “Pew Research Center” (December 20, 2010) - https://www.pewresearch.org/social-trends/2010/12/20/baby-boomers-approa....

PwC and the Urban Land Institute, Emerging Trends, 56.

Keller Easterling, Medium Design: Knowing How to Work on the World (London and New York: Verso Books, 2021), 10.

See especially: ARUP, Rethinking Timber Buildings; Ulrich Dangel, Turning Point in Timber Construction: A New Economy (Basel, Switz.: Birkhäuser, 2016); Daniel Ibanez, Jane Hutton, and Kiel Moe, eds., Wood Urbanism: From the Molecular to the Territorial (Barcelona and New York: Actar Publishers, 2019); Susan Jones, Mass Timber: Design and Research (San Francisco: ORO Editions, 2018); Hermann Kauffman, Winfried Nerdinger, Martin Kuhfuss, and Mirjana Grdanjski, eds. Building with Timber: Paths into the Future (Munich: Prestel Publishing, 2011); Gray Organschi Architecture, Timber City - http://timbercity.org.

“Forest Area by Country” - https://www.worldometers.info/food-agriculture/forest-by-country/, accessed November 10, 2021.

Mark Nechodom, Dennis Becker, and Richard Haynes, “Evolving Interdependencies of Community and Forest Health,” in Forest Community Connections: Implications for Research, Management, and Governance, eds. Ellen M. Donoghue and Victoria E. Sturtevant (New York: Resources for the Future, 2018), 94.

“Forests and Climate Change,” “Food and Agriculture Organization of the United Nations” - https://www.fao.org/3/ac836e/AC836E03.htm, accessed November 14, 2021.

Nathan Stephenson et al., “Rate of Tree Carbon Accumulation Increases with Tree Size,” Nature 507 (2014): 90-93 - doi:10.1038/nature12914.

David Logan, “Global Exports of U.S.-Grade Framing Lumber,” Eye on Housing - National Association of Home Builders (March 11, 2021) - https://eyeonhousing.org/2021/03/global-exports-of-u-s-grade-framing-lum....

Peter Dauvergne and Jane Lister, Timber (Malden MA, USA: Polity Press, 2011).

Michael Caton, “How Architects Can Transition to Buildings as Products, Not Projects,” Architect (October 20, 2020) - https://www.architectmagazine.com/practice/how-architects-can-transition....

Ibid.

Joel Kotkin, The Human City: Urbanism for the Rest of Us (Evanston IL, USA: Agate B2 Books, 2015), 16.

Many thanks to the reviewers for your time, observations, and suggestions.

Planning and Design by the University of Arkansas Community Design Center, and the Fay Jones School of Architecture and Design, and Department of Architecture: Stephen Luoni, Claude M. Terral III, Tarun Kumar Potluri, Kacper Lastowiecki, Joshua Levy, Jacob Caylon Alford, Keturah Bethel, Mary Grace Corrao, Matthew A. Scott and Wenjie Zhu.

Project fees to the University of Arkansas Community Design Center for the design research study were provided by the client, the Weyerhaeuser Giving Fund. Publication funding was provided by the University of Arkansas at Fayetteville and the UA Community Design Center.

All figures: © University of Arkansas Community Design Center.

Stephen Luoni is the director of the University of Arkansas Community Design Center (UACDC) where he is the Steven L. Anderson Chair in Architecture and Urban Studies and a Distinguished Professor of Architecture. Under his direction since 2003, UACDC’s design and research have won more than 180 awards, all for urban design, research, and education. Luoni’s work specializes in interdisciplinary public-interest projects combining landscape, urban, ecological engineering, and architectural design. E-mail: sluoni@uark.edu